e-Commerce Shopper market research: retail trends

LIKE YOU, C+R RESEARCH HAS BEEN MONITORING DEVELOPMENTS IN THE ONLINE AND BRICK-AND-MORTAR GROCERY SPACE.

Daily headlines announcing a seismic shift in the industry drive home the urgency of understanding omnishoppers and managing touchpoints that will drive their decision-making now and in the future.

Retailers and manufacturers must stay ahead of the online adoption curve to ensure they get their share of the tens of billions at stake.

While grocery dollars have been the slowest category to shift online, compared to categories like electronics and apparel, consumer demand for online grocery options has led to a notable decline in brick-and-mortar sales.

The linear path to purchase was radically changed with online shopping. This new path to purchase is far more circuitous. The addition of two fulfillment methods to the grocery category—delivery and pickup—demands that we understand the digital and offline touchpoints along the way.

We developed three personas to truly understand and illustrate the real reasons omnishoppers choose brick-and-mortar grocery shopping, online grocery delivery, or grocery pickup.

We utilized a receipt-based panel that gave us access to actual purchase behavior. To elevate our understanding of our omnishoppers, we then divided them into three groups: brick-and-mortar, online delivery, and pickup. Finally, we sent a survey to these folks to further segment them based on their food values.

This hybrid approach led us to rich, tangible behavioral and attitudinal data that allowed us to flesh out who they are, and why they choose each fulfillment method.

Three shopper personas

Brick-and-mortar only

This is Brock.

He’s a brick-and-mortar-only kind of guy.

Brock is pretty satisfied with his in-store experience. He knows all about his online options. He isn’t out of touch with technology, but he is definitely in touch with his produce. He’s tactile, and he enjoys the hunt for in-store deals. In fact, we saw that he overindexed on ‘value’ as one of his chief values when we broke out our grocery shopper segments.

He feels that going into the store allows him to discover specials or deals. He finds it much easier to use coupons and price-match in-store—plus there are no shipping fees.

He often pops into his local grocery store to fulfill an immediate need. He wants to grab just a few specific items, and he feels gratified instantly.

Mostly brick-and-mortar

MEET DOREEN.

She likes groceries delivered straight to her door—especially bulky items like dog food for her little friend, Tina Spay.

Doreen shares some characteristics with Brock. She skews gen pop, and she does most of her grocery shopping at brick-and-mortar stores—93%. However, she has still shifted 7% of her dollars to online.

But why? Well, she’s not digging the whole in-store experience. Her satisfaction level there is about 57%. We asked her why she shifted her shopping online. While skipping the crowds and checkout lines are a bonus, Doreen is more focused on the benefits of online—like saving money and locating hard-to-find items. She also likes to place her order anytime, 24/7.

She’s overindexed on two segments: label-checker and socially conscious nurturer. This means she likes organic, minimally processed foods with short ingredient lists. She cares about fair trade, and she likes being able to find vegan and vegetarian items.

Prefers online grocery

here’s kara.

She’s more likely to pick up her groceries. Her daughter, Ceecee, is adorable—but it’s not a whole lot of fun to bring her to the store.

Kara does skew younger, but it’s really her child(ren) who have led her to click and collect. Her satisfaction with the in-store experience is 48%, which is pretty weak compared to her online satisfaction of 67%.

Naturally, she wants to limit the time shopping in-store with her children. Not only is it a time and energy saver, it also reduces the number of unplanned purchases for products requested by her children.

Her preferences are reflected in her values. She leans toward being a ‘convenient taste habitualist,’ which just means, “Hey, I need things that I know my family is going to love that are quick and easy. Hit repeat.” That’s why online works so well for her. Once she has built her online basket just how she likes it—BOOM! Subsequent orders are a breeze.

One of the verbatims that captured the essence of Kara’s cohort was, “I needed diapers, but I didn’t want to take the baby shopping or stand in long lines. My oldest child had practice later, and I didn’t have time to do everything.”

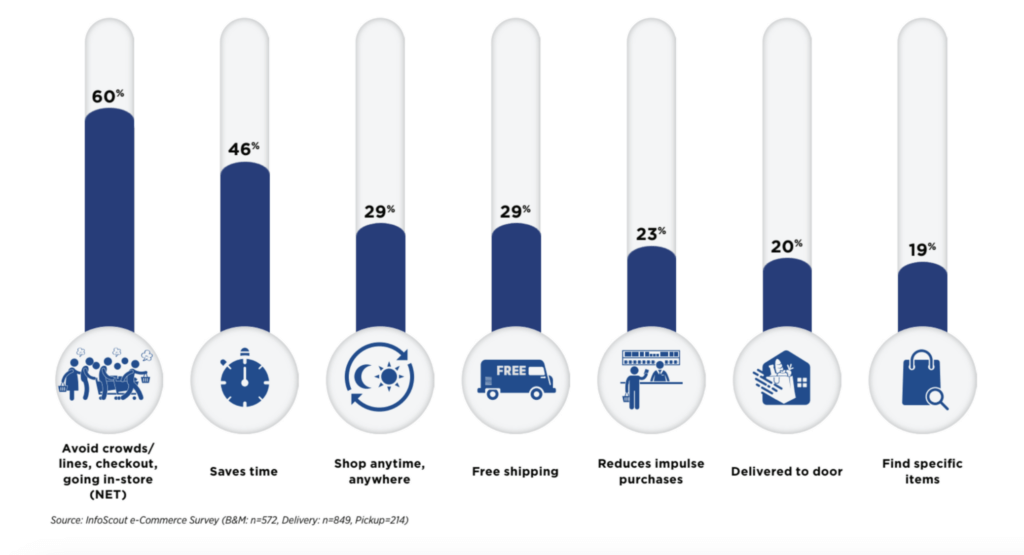

TOP REASONS FOR SHIFTING

TO ONLINE GROCERY.

Not surprisingly, when directly asked why they have switched online, we see similar reasons people do most things (convenience, stress reduction, ease, saving money, etc.). These are not unique to making the switch from brick-and-mortar to online. What’s more revealing is understanding the particular moment online became more convenient, faster, easier, etc., that pushed people to overcome the key hurdle of initial setup.

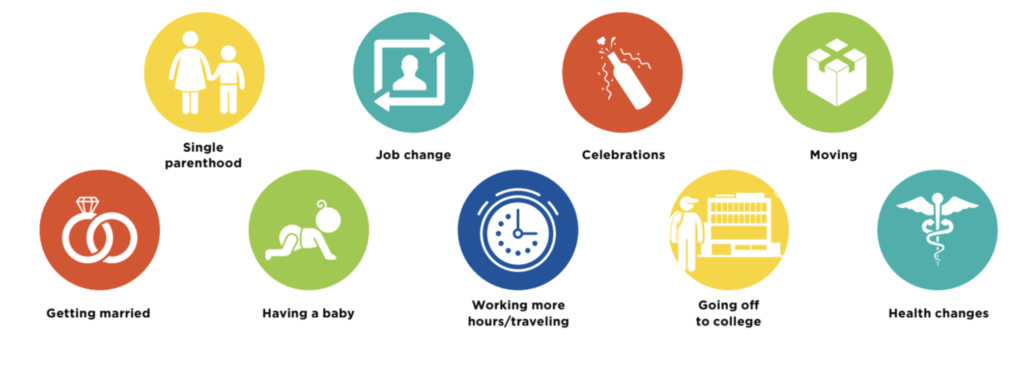

LIFE CHANGES OFTEN LEAD TO THE TRIGGER MOMENT

FOR THE SHIFT.

When asked to recall what led them online, we expected most people to mention a gift card or offer that encouraged them to try online. While promotions were a big driver, we were floored by how well people remembered the time in their lives where online became more advantageous than brick-and-mortar.

SO HOW DO WE CAPTURE THEM? LET’S BREAK DOWN HOW WE MIGHT CAPITALIZE ON THEIR TRIGGER MOMENT.

1. Overlay shopper personas on your receipt-based data

Divide and segment your category and brand buyers to understand the nuances driving what, how, and why they are shopping online. Build your conversion and retention strategy based on your e-Commerce shoppers’ path to purchase.

2. Link to relevant life events.

Identify key life events—marriage, having children, going off to college, etc.—that have the strongest link to both shifting online and your brand and category.

3. Build a predictive model to identify your target/s.

Take what you know about your brand and category and overlay the personas and relevant life events to create a model that will predict when your consumers will make the shift from brick-and- mortar to online. Then, use a tool like receipt-based tracking to test prediction accuracy.

4. Create a plan to capture your prospects.

Now that you’ve identified when your target will shift to online and why, utilize a mixture of quant and qual to test different messaging, innovation, and merchandising ideas to capitalize on the shift and ensure your brand and category are in the basket.

Jennifer Casey

Senior Research Director, C+R Alum