The Implications of Behavioral Economics on Market Research

Filed Under: Best Practices, Market Research

Lynne Bartos

Vice President and Marketing Content Strategist, Marketing

You may be thinking, “how does anything related to economics deal with conducting market research?” Well, as it turns out Behavioral Economics has an incredible impact on how people answer our surveys, talk about products and more. So we really do need to take a few of these theories into consideration when we develop surveys.

First, some background: Behavioral Economics is rooted in the overall study of economics. Classical economic theories suggest that we always make rational decisions, that we always pursue optimal options, and that we are excellent at calibrating risk as well. Now, I think it’s pretty clear that this is not always the case. In fact, people are actually quite irrational when making choices. Luckily, Behavioral Economics realizes this and therefore, takes this into account.

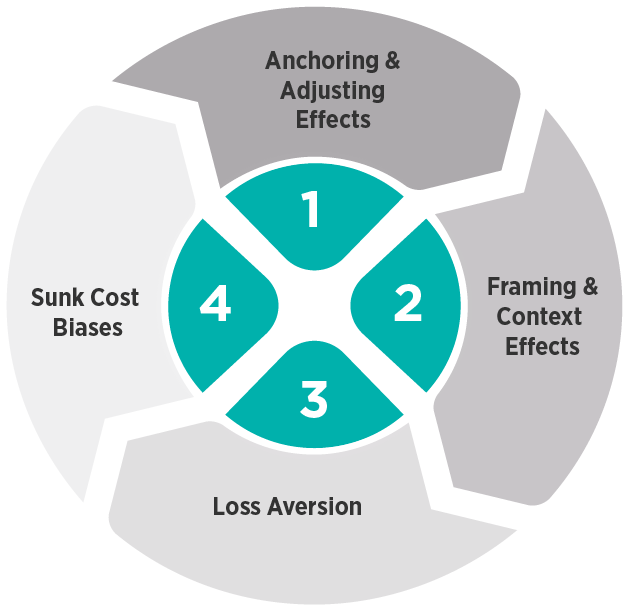

Now, going off that, here are four different Behavioral Economic theories that have a particular impact on market research and how we can take steps to alleviate how much they affect market research.

1. Anchoring and Adjusting Effects

The anchoring effect says that peoples’ judgements tend to be anchored on an initial piece of information. Therefore, the overall “Anchoring and Adjusting” effect says that people make subsequent judgements based on the original anchor.

One example of this occurring is in a study where two groups were asked how old Gandhi was when he died. In a question asked right before this one, the first group was asked if they believed Gandhi died before or after the age of 140, and the other was asked if they thought he had passed before or after the age of 9. When then asked the follow up question of how old Gandhi was when he died, the people who had age 140 as their anchor had an average guess of 67, while the group that had 9 as their anchor had an average guess of 50. We can clearly see that the people who were first asked if they thought he died before or after the age of 140 had a much higher average in the follow up question. This illustrates that the initial number they were exposed to substantially affected and skewed their responses.

This has several implications for market research:

- First, when developing questions we need to keep in mind that the range of options and the magnitude of values WILL influence responses.

- Second, we also have to consider placement of questions that have values or ratings associated with them; respondents’ answers may be anchored around these prior values.

2. Framing and Context Effects

Framing and context effects explain that the context in which choices are presented often affect consumers’ opinions of these choices.

- For example, I ask if you would prefer 99% fat free yogurt or if 1% fat induced yogurt? You are probably going to say you prefer the 99% fat free yogurt, even though these are the exact same thing.

So, it boils down to how each option is worded; in this case, they take a very different approach, and the result is one sounds much more appealing than the other.

The main implication of this on market research is that the context in which you word your questions can strongly influence respondents’ judgements and opinions, so it is important to make sure your questions are framed correctly.

3. Loss Aversion

Loss Aversion and the effects it can have on market research has to do with the fact that people fear loss more than they value gains. Here’s an example:

- Ph.D. students registering for classes were separated into two groups and given two different scenarios.

- One group was told that there was a penalty fee for late registration while the other group was told that there was a discount for early registration.

So who registered early? Turns out 93% of those in the group who were given the penalty fee scenario and 67% of those given the discount scenario did. This further illustrates the point that we really care more about minimizing our chance of loss.

Again, this has an impact on how we develop survey questions; specifically think how costs and benefits are framed in questions as they can have an impact on responses.

4. Sunk Cost Biases

It would make sense that when people find themselves in a hole, they should stop digging, but sunk cost biases proves this is not the case. If we truly made rational decisions, we would take future costs into account, but as we know, consumers are not always rational and will often find themselves in a situation where previous sunk costs affect their decisions.

This can be seen in a study that was conducted at the race track:

- Those who already placed their bet (and paid their money) thought they had a higher chance of their horse winning than those who were on their way to place their bet. In other words, once they had already spent their money, they were more confident that their horse would win.

So, for us in the market research industry, it’s important to remember that past sunk costs can affect perceptions, both positively and negatively. And, the presence of past sunk costs can also affect participants’ perceptions of price when evaluating future products and services.

So, our goal is to be aware of these potential biases when developing our surveys, and do our best to try to reduce them. Specifically, we need to be cognizant of the response options we provide including:

- The value ranges given,

- Question order,

- Phrasing, and

- Price comparisons.

These are all good reminders to keep in mind during the survey development process. We will never be able to completely alleviate biases from respondents’ answers because they are so engrained, but keeping these issues “top of mind” can help us in our quest for obtaining the highest quality data possible.

explore featured

Case studies