COVID-19: The Impact on Consumers’ Wallets

Filed Under: Best Practices, COVID, Market Research, Shopper, Grocery, Retail, Quantitative Research

Consumer Costs of COVID-19

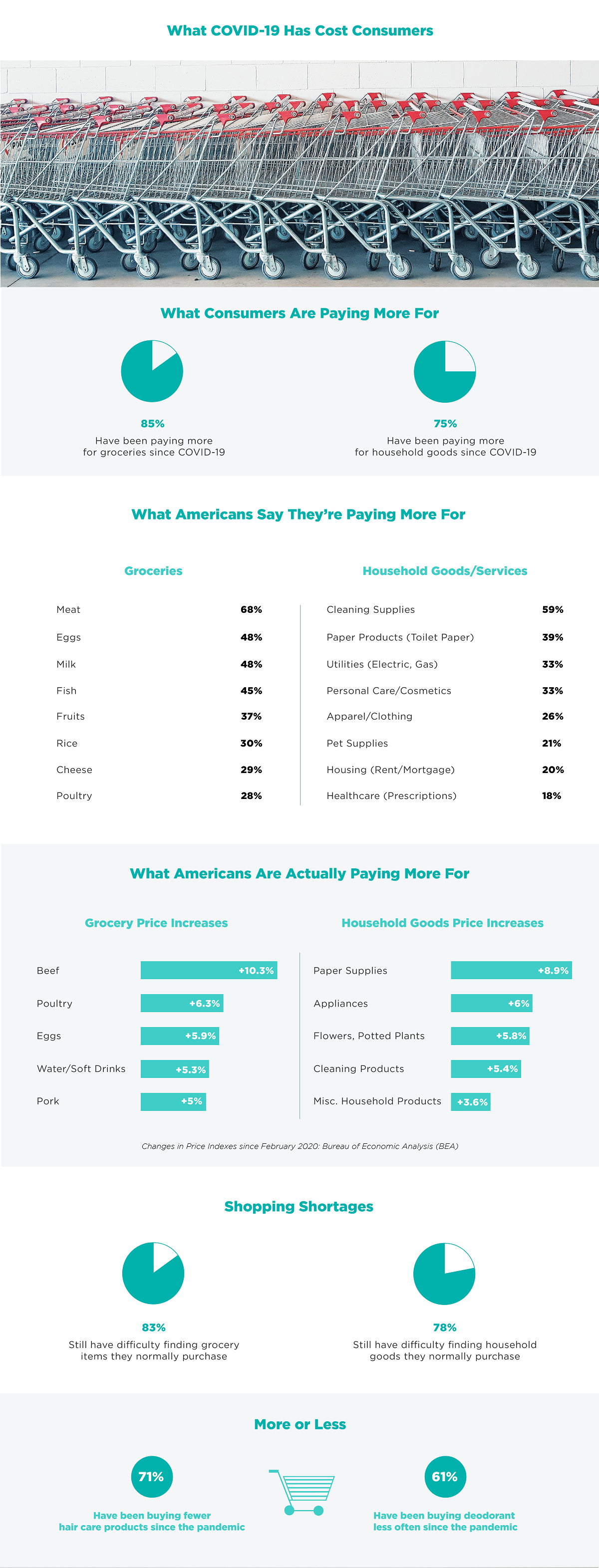

If you’ve noticed higher prices at the checkout aisle since COVID-19, you’re not alone. Americans across the country have been paying more for staples such as meat, eggs, and poultry as well as everyday household goods. Grocery prices skyrocketed beginning in March and still haven’t fallen to pre-pandemic levels.

In order to find out how Americans have been adjusting to higher prices, we surveyed 2,040 consumers and asked them how COVID-19 has affected their budget, shopping habits and diets.

Shoppers See Higher Prices During the Pandemic

Since the pandemic, the majority (85%) of American consumers say they’ve been paying more for groceries. Among grocery items shopped for, meat, eggs, and milk were among the top three items that Americans say they’ve been paying more for since COVID-19.

Beef and eggs are also among the top food items that have seen the greatest price increases since the pandemic. According to the Bureau of Economic Analysis (BEA), beef prices are 10.3% higher than they were in February of this year, while poultry is 6.3% higher and eggs are 5.9% higher.

Food isn’t the only thing that’s been hitting the pocketbooks of Americans; three quarters (75%) of Americans say they have been paying more for household goods. This sentiment aligns with household items such as paper supplies, appliances and cleaning products, which are all priced higher since the pandemic, according to the Bureau of Economic Analysis (BEA).

Along with higher prices, consumers say they’re still experiencing shortages for certain items. For products they normally purchase, most (83%) say they are still having difficulty finding groceries and over three-quarters (78%) are still having trouble finding household goods.

COVID-19 Shopping Budgets

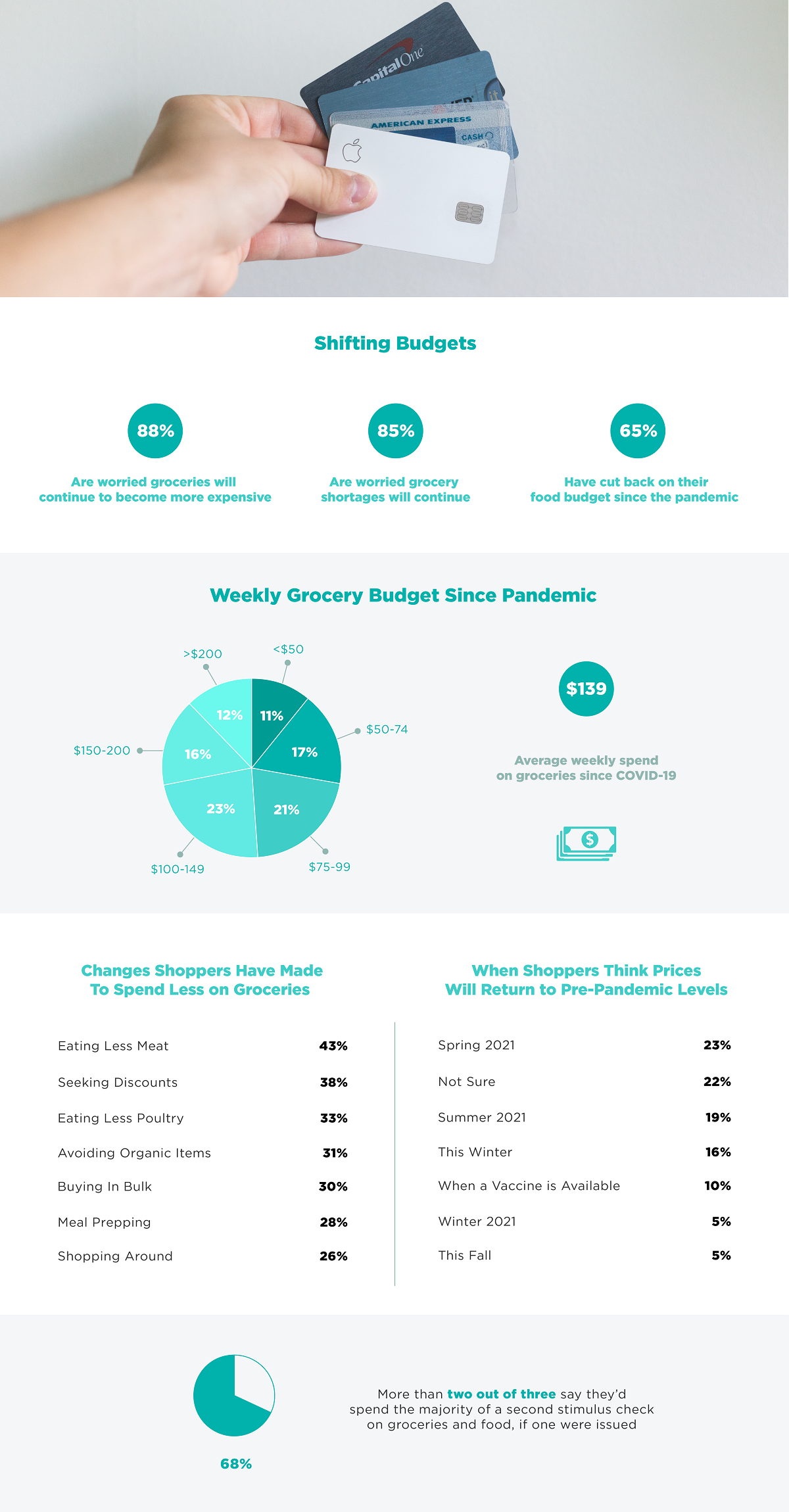

As consumers continue to navigate the uncertainties of COVID-19, about two-thirds (65%) say they’ve been cutting back on their food budget. On average, consumers say they’re spending $139 per week on groceries and the vast majority (88%) are concerned that grocery prices will continue to rise rather than level out or decrease. Along with cutting back on their budgets, consumers are making other changes to their shopping habits such as eating less meat, seeking discounts, eating less poultry, and avoiding organic items, which tend to be more expensive.

When will these higher prices return to pre-pandemic levels? While no one has a crystal ball, nearly a quarter of consumers are hopeful they will see some relief at the checkout counter by spring 2021, but just about the same proportion aren’t sure.

COVID-19 Second Wave?

Many consumers are wondering if we will see a “second wave” of COVID-19. But if a second wave were to happen, how much of an impact will it have on grocery and other household products and services?

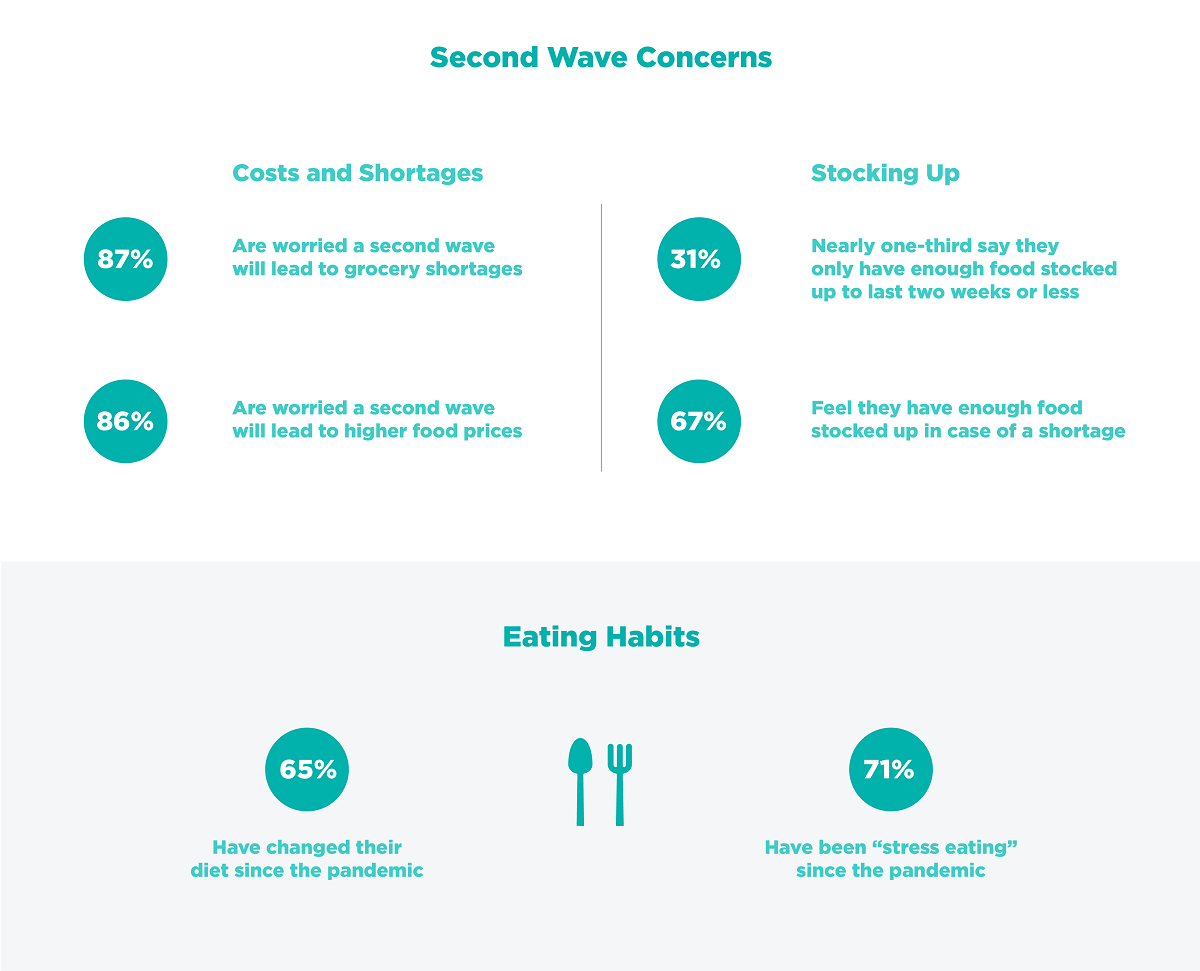

According to consumers, most (87%) fear it will lead to grocery shortages and a similar proportion (86%) are concerned a second wave would bring even higher prices.

Two-thirds of consumers (67%) are preparing themselves by stocking up on essential food items, while the other one-third have only stocked enough food to last two weeks or less.

With so much uncertainty regarding COVID-19, it’s no wonder that 7-in-10 consumers say they’ve been “stress eating” since the pandemic.

COVID-19 Shopping Habits

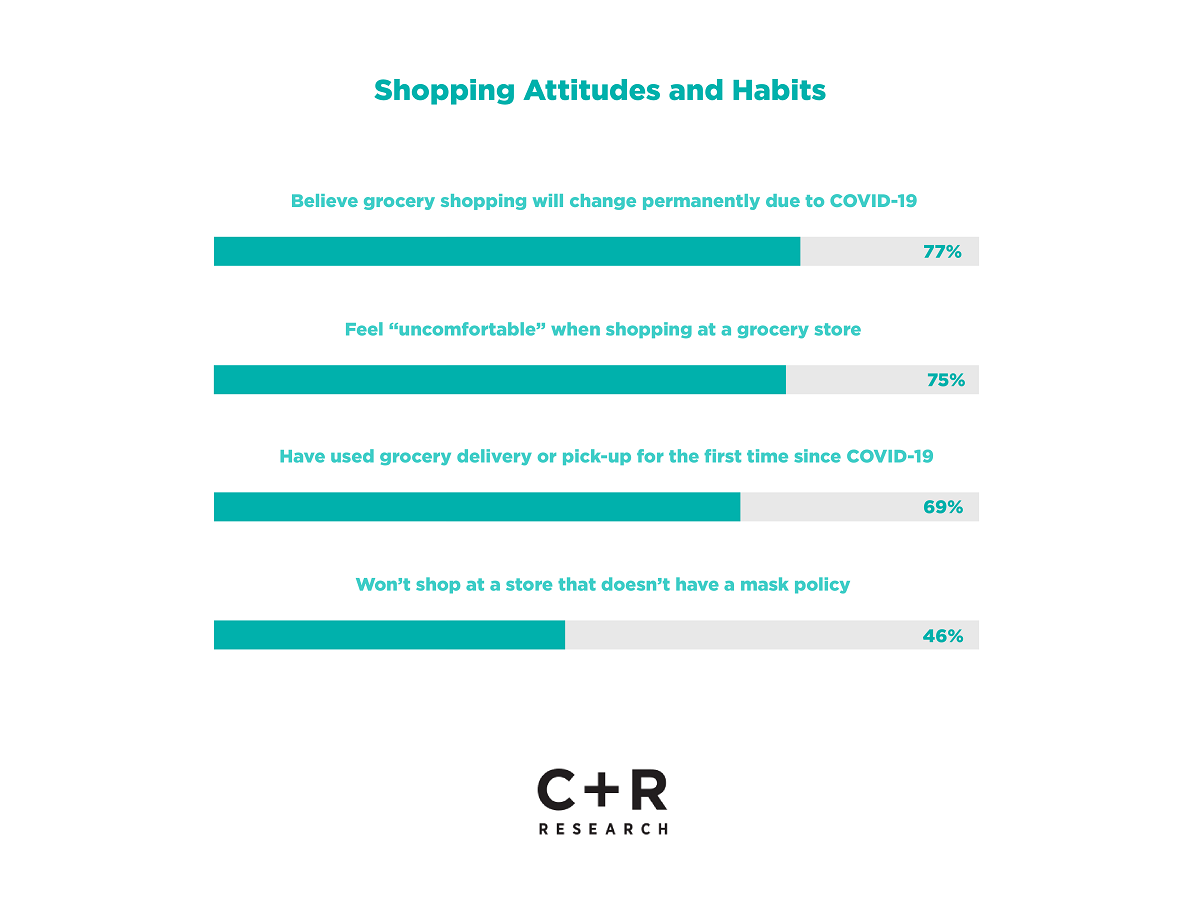

Despite many national grocery chains implementing safety guidelines and putting social distancing policies in place for both shoppers and employees, most consumers still feel uneasy about shopping inside of a store. Attendant to that, over two-thirds (69%) of consumers said they had started using alternative shopping methods like grocery delivery services or grocery pick-up since the start of the pandemic.

While it’s too early to tell exactly what the future holds for consumers, it’s clear that shopping habits and budgets have already changed. But will these changes become permanent? According to consumers, about three-quarters (77%) believe grocery shopping will change permanently in some form post-pandemic.

As the pandemic continues, perhaps consumers will become more comfortable with changes such as grocery delivery and pick-up, or contactless payments at the checkout. Whether these changes alter shopping forever remains to be seen, but it is clear consumers are prepared to adapt and navigate their way through the pandemic and beyond.

Methodology

For this report, we surveyed 2,040 self-reporting Americans via Amazon’s Mechanical Turk survey platform from August 14 to August 15, 2020. 55% were male and 45% were female with an average age of 39. Income: Under $20K: 10%; $20,001-40K: 23%; $40,001-60K: 32%; $60,001-80K: 19%; $80,001-100K: 9%; $100,001+: 7%.

Household size: 1 person: 11%; 2 people: 19%; 3 people: 29%; 4 people: 32%; 5 or more: 9%. Note: Amazon Mechanical Turk respondents may be more likely to use Amazon services such as Amazon Fresh.

Data source: Price Indexes for Personal Consumption Expenditures, Bureau of Economic Analysis

Fair Use

When using this data and research, please attribute by linking to this study and citing https://www.crresearch.com/