Four Imperatives for Keeping Brands Relevant in the Coming Months

Filed Under: COVID, Immersive Online Discussions, Qualitative Research

Paul Metz

Chief Executive Officer, C+R Team

The initial shock of the COVID-19 pandemic has mostly passed and panic has, to some extent plateaued, according to recently published research by The Ad Council. The threats are now known, and most Americans have shifted into coping mode; and unfortunately for many, survival mode.

While the full script of this historical pandemic has not yet been written, now is the time for products and brands to start understanding the path ahead and what might be different in the coming months as well as further down the road, once COVID-19 is in the rearview mirror. Many companies have frozen their budgets — appropriately so — in order to retain staff and ride out the economic storm. However, right now could be the ideal time to make a few smart investments in new research to understand emerging opportunities and make critical decisions about brand positioning and messaging.

Before discussing marketing or research, let’s first size-up what’s going on in consumers’ minds.

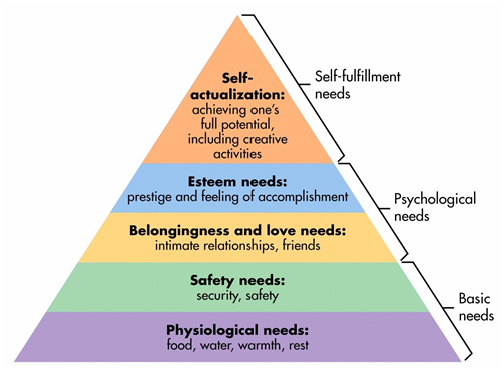

I didn’t study psychology in undergrad for nothing, so let’s consider COVID-19 through a familiar lens: Maslow’s hierarchy of needs.

(Source: https://www.simplypsychology.org/maslow.html)

As originally conceptualized in the 1940s, Maslow’s hierarchy has five levels, or categories, of human need and motivation. He later updated the hierarchy in the ’70’s to include Cognitive Needs (knowledge, curiosity, exploration, meaning and predictability) and Aesthetic Needs (appreciation and search for beauty, balance, and form), both of which slot into the model between Esteem and Self-actualization; and finally, Transcendence Needs (values beyond personal self), which occupies the highest “rung” on the ladder of needs. For most people, according to Maslow’s research, the needs of a lower level must be fully or mostly met before a person is motivated to seek higher level needs. This is not universally the case — as there are well-known cases of “creative geniuses” neglecting even basic needs in the pursuit of their art; but for most people, the order of needs holds true.

When life is “normal”, that is, not impinged by crisis or situations that create barriers to fulfilling needs, people will expend most of their mental energy in the upper half of Maslow’s hierarchy. However, an unexpected and uncontrollable event like the Coronavirus pandemic can significantly disrupt the normal order of need-fulfillment and in fact, turn the model on its head.

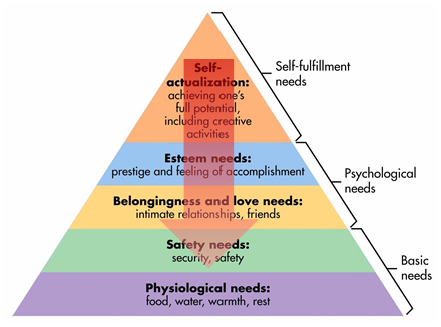

COVID-19 has brought a psychologically lethal combination of experienced hardship + the threat of illness and/or financial instability + uncertainty about the future, which together drive emotions of fear and anxiety, which then lead to a reshuffling of priorities.

The result for many is that need-fulfillment and psychological motivations have been driven down to the lowest tiers of Maslow’s hierarchy:

Primary day-to-day concerns are now about fulfilling basic needs: food, predictability of shelter, health and physical safety of self and loved ones. This has led to a well-documented shift in consumer spending — captured quite well in this New York Times interactive article. For some, fears over personal safety have even driven a recent spending spree on guns presumably for the psychological reassurance they provide.

Putting on a marketing hat, it’s important to recognize that all of this is highly segmented. Geographically, economically, racially, politically and psychologically, there are multiple, if not many “Americas” in terms of the impact, perceptions, and reactions to Coronavirus. Some will be hit hard, others hardly at all. Segmented perceptions ARE the reality.

Imperative #1: Know and understand the segments that your products, services, and solutions serve. It is their realities and perceptions you need to speak to in current and future marketing communications.

- Where is your product portfolio on this spending map?

- Where does it operate on Maslow’s hierarchy?

- Does your product set deliver the comfort and security of basic needs? Or will it serve a bigger role in the psychological recovery that will unfold as the pandemic subsides, and consumers start returning their attention higher-up the hierarchy? It’s important to position your product and services against the current needs in your target consumers’ inner minds. Routine promotional tactics may be far less important in the current environment than establishing a psychological connection.

Imperative #2: Recognize the role that your product category plays in consumers’ lives right now.

Marketing needs to be at the right temperature (mood) and not aim too high at the risk of sounding clueless, heartless, or opportunist. Be prepared with an agile messaging strategy that can adapt as consumers heal from the psychological wounds of the pandemic and are ready to shed some of their anxiety.

The shift down Maslow’s hierarchy coupled with intermittent product scarcity means that the role and meaning your brands have in consumers’ lives may be evolving. Little things that mattered in the past may no longer matter. Conversely, little things that didn’t matter before, might now matter a lot. Consumers are no longer on “auto-pilot” as they shop and spend.

We’ve heard consumers talk about this very phenomenon in our free weekly online consumer panel discussions. Consumers are now willing to buy what is available, rather than clinging to pre-pandemic brand loyalties.

Purchase decision hierarchies are different right now. Not all the features, claims and benefits that were important in the past are still relevant. Will they return to relevance when the pandemic ends? Or will consumers’ experiences and satisficing behaviors lead to an enduring reevaluation of priorities?

Imperative #3: Learn what differentiates your brand now, during the pandemic, and try to catch a glimpse of what will matter and differentiate brands in your category when the pandemic abates.

Adapting and tailoring marketing communications may prove to be quite tricky in the current environment. Some of the dynamics at play in consumers’ minds are psychological factors that consumers can’t easily articulate or express – decisions are infused with and shaped by feelings and emotions. And not all consumers process such emotions in the same way. Add to this the complexity of rapid change that makes for dramatic headlines in the always-on news media. Emotions that dominate this week may not exist a month from now.

Imperative #4: Invest in tracking research now — but do it differently.

Maybe you’re already well-poised with ample research and have a good handle on all of these consumer dynamics. But if you’re not, I feel that now may be the right time to think a little differently about tracking research. Conventional wisdom is that tracking is done quantitatively. But we find ourselves in a different circumstance right now. Standard, surface-level trended metrics aren’t going to produce the insights you need to optimally navigate the path ahead. It’s time to get more intimate with your target.

Seek to understand feelings and emotions through stories and video. Get a deeper understanding of your target’s priorities and motivations. How? Through qualitative tracking. Iterative online qualitative discussions or a simple online insights community can both deepen and elevate your insights. These need not require a huge investment; qualitative research is wonderfully scalable. Plus, ongoing qualitative research can easily pivot on-the-fly and capture fast-evolving consumer sentiment without the limitations of static tracking surveys.

Couple this qualitative tracking with all of the things you hopefully already have in place — tracking surveys, social media listening, publicly available high-level COVID-19 sentiment surveys — and you’ll develop the holistic understanding your brand team needs to connect with consumers with authenticity and relevance no matter what unfolds in the rest of 2020.

explore featured

Case studies