Net Promoter Score (NPS): Managing the Obsession

Filed Under: Best Practices, Market Research, Customer Satisfaction

A recent Wall Street Journal article, “The Dubious Management Fad Sweeping Corporate America” from by Khadeeja Safdar and Inti Pacheco, highlighted corporate America’s “obsession” with Net Promoter Score (NPS). And, I have to say, as someone who has worked with clients on NPS for many years, I agree with many of the authors’ points. So, as marketers how do we manage the “NPS Obsession?”

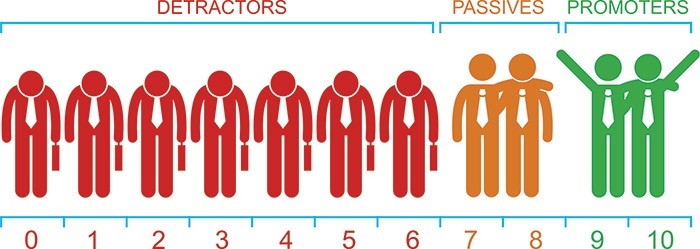

For those not familiar, NPS is based on an 11-point scale “likelihood to recommend” question. Those with a 9-10 rating are considered “Promoters,” a 7-8 rating “Passives,” and a 0-6 rating “Detractors.” The score is calculated by subtracting the percent of Detractors from the percent of Promoters.

As mentioned in the article, some put all their eggs in the NPS basket – with some even using it as a basis for performance-based bonuses. I agree that there are flaws in doing this, and we know that NPS doesn’t always correlate to sales (as is also mentioned in the article).

But, can NPS be useful? Yes, if done the right way, and if the proper additional context is included for the full picture. So, what do we typically suggest and use as our guardrails?

- Make sure you’re talking to the right people. It may seem simple and obvious, but people can’t say that they’d recommend a brand that they have no experience with or haven’t purchased. So, make sure you’re talking to brand users/purchasers!

- Include an open-ended “why” question after NPS. This will identify the reasons for being really delighted or really upset. But, it also tells us which customers are truly neutral even if they are classified as a Detractor (after all, for many people, the middle of a scale is what they consider “neutral”). We also learn with the open end that some people just may not recommend brands or companies to others (but that doesn’t mean they’re unhappy). Or, others may be a “Promoter” but only because they see that company as the only available option (for example, a utility company).

- Include additional metrics in the survey. This will help to fully understand customer sentiment and satisfaction. It also paves the way for potentially creating a “Brand Power Score” (a customized weighted composite score that still provides clients with one easy-to-digest number that can be tracked over time – but it goes beyond one single metric).

- When analyzing NPS, look at more than just the final score. NPS is a calculation, so slight differences in Promoters and/or Detractors (that aren’t significant) can make it look like there’s a big difference in NPS. We can’t conduct significance testing on NPS (because it’s a calculation), so we typically only note a difference in NPS as meaningful if there is a significant difference when looking at Promoters or Detractors.

NPS has its place when trying to determine how consumers feel about your brand (and can provide some insight into how loyal they are) – but, we always try to have a discussion with our clients, so they understand the caveats of using NPS as their sole criteria for brand loyalty.

explore featured

Case studies