Shopper Payment Evolution, Part 1: How Shoppers Choose to Pay Today

Filed Under: Shopper, Ecommerce, Grocery, Retail, Path to Purchase, Shopper Journey

Kayla Myhre

Director, Shopper Insights Research

The start of a new year is often a natural moment to pause and reflect, both on what’s changed and what’s ahead. Just as we think about our own lives and goals, it’s also an opportunity to reflect on the broader shifts happening in shopper behavior.

Financial resolutions are a big part of this season. Whether it’s spending less, saving more, or finding ways to boost income, these types of goals can influence how shoppers choose to pay for everyday purchases. Payment choices aren’t just about convenience—they can reflect deeper financial priorities.

In C+R’s latest research, The ShopperPulse Perspective: Insights on the Payment Evolution, we dive into how payment methods have evolved since pre-COVID years and how those changes are shaping today’s shopper behaviors. Here, we’ll unpack these findings. Then, stay tuned for Part 2 of this series where we’ll dive deeper into the data driving these findings.

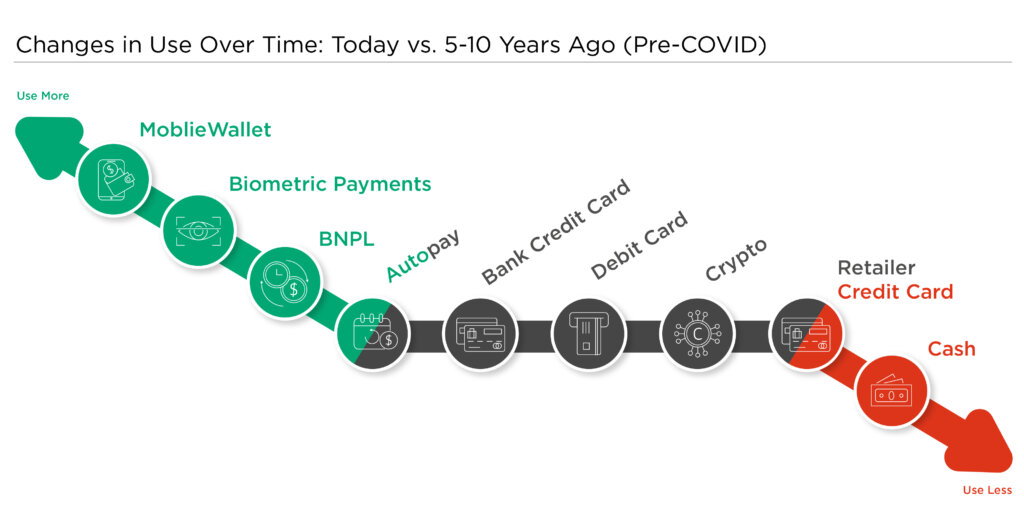

Human beings are creatures of habit, often resulting in slower, more gradual adoption of new payment methods. Still, in the past 5-10 years, we’ve seen steady adoption of more tech-forward methods gaining traction.

Mobile Wallets have seen the largest jump in use. In recent years, mobile wallets have become more integrated with both Android and iOS operating systems, as well as offered as a payment option by more retailers.

Biometric Identifiers have jumped in use as more retailers have begun to accept them. Notably, you may have used your palm print to pay for your groceries at Whole Foods Market.

Buy Now, Pay Later (BNPL) use continues to grow as shoppers feel the financial strain of rising prices and the majority of retailers across industries have adopted it.

Long-standing go-to payment methods have seen consistent use over time. Autopay Subscriptions, Bank Credit Cards, and Debit Cards continue to deliver on shoppers’ need for ease and convenience, as they are still some of the most widely accepted payment types.

Crypto and Retailer Credit Card use has also remained predominantly constant for the smaller portion of shoppers who use these methods, despite lower adoption among shoppers overall.

Despite still being a preferred payment method for nearly 1 in 10 shoppers, Cash use overall has been declining since pre-COVID times. With the continued growth of e-commerce and an increasing number of retailers going cashless, it has become less relevant compared to more popular debit and credit card options.

So, as we’ve seen, payment methods are evolving, but not overnight. While traditional payment methods like debit and credit cards remain dominant, tech-driven options—especially ones that also allow payment on credit—are steadily gaining ground. These shifts reflect more than just the need for convenience. They signal how financial goals and lifestyle changes are influencing how people shop and pay for everyday needs.

It’s also important for brands and retailers to understand that staying ahead of payment trends isn’t just about offering more options. It’s about understanding the motivations behind these payment decisions. Aligning payment flexibility with shoppers’ financial priorities and preferences can remove friction at checkout and ultimately strengthen loyalty.

But, this is only the beginning! In Part 2 of this series, we’ll unpack more of the data and explore more of what has driven these changes. Then, stay tuned for more research drops happening over the next several months. We’ll ultimately look forward and explore which methods are poised for growth, which may decline, and what these changes mean for your shoppers in the year ahead.