COVID-19 Pandemic: Live Consumer Panel #2 – Five Takeaways

Kat Figatner

Senior Vice President, In-Person Qualitative Research

On April 2, 2020, we hosted our second Consumer Roundtable discussion to take a pulse on consumers’ evolving attitudes and behaviors during the coronavirus pandemic. This week there was a decidedly more somber tone as we head deeper into this crisis and impact becomes more financial and personal.

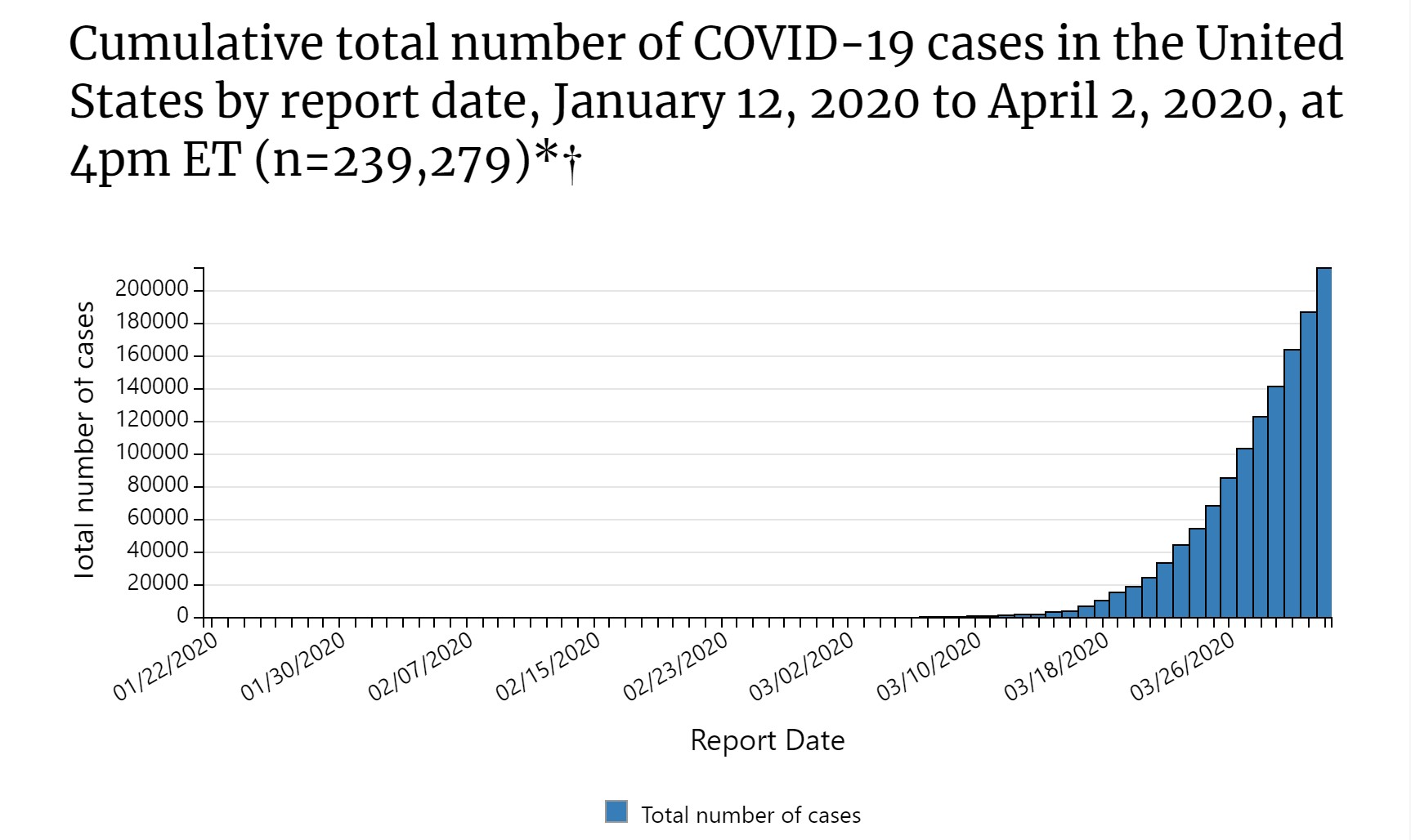

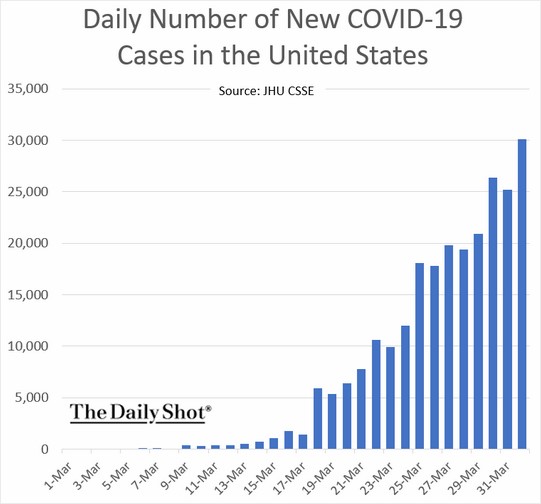

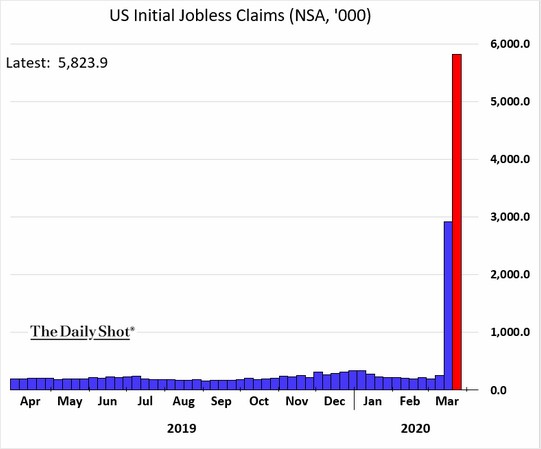

For context, in the week between the two sessions, the number of COVID-19 cases more than doubled to over 200,000 cases, and the White House announced that social distancing guidelines were extended until the end of April. On the morning of the second panel, the government released the latest unemployment numbers – a record 6 million Americans filed their initial jobless claims.

Here are 5 takeaways of what we learned:

1. Consumers are being more thoughtful about expenses and want their purchases to matter. Some consumers aren’t working due to company-mandated furloughs as well as determining it’s too risky for their health. Without this income, they are being more mindful of spending. They are getting in control of expenses by eliminating temptations and auto-pilot subscriptions.

Instead, consumers are turning directly to local businesses. Like we heard in the first panel, they feel good about supporting local restaurants and other businesses to help keep them afloat. Purchases that give a portion of the profits to a charity are also motivating. How a company treats its employee’s matters too – consumers want to support brands that are able to pay workers even if stores are closed.

“I manage a convenience store and my doctor told me that was the worst place to be working. I worked 50-60 hours a week, and now I’m not doing any of that.”

“My company furloughed everyone so I unsubscribed from my frivolous purchasing. I was a two-times-a-week Amazon shopper. I deleted my apps so I wouldn’t be tempted. I canceled my Fab Fit Fun box.”

“I’m trying to buy local things these days. If I’m going to buy something, I want to buy food from a local restaurant because I want to keep them in business.”

“I’m noticing the businesses creating a product where a portion goes to charity. They’re creating a bracelet where 10% goes to charity or have a takeout night. I’m more interested in buying from them. You’re helping a charity and the business.”

“Ulta are still paying their employees so I’ll continue to shop there.”

2 Consumers are turning to alternative fulfillment methods to avoid in-store shopping, but their needs are not being met. While consumers want to switch to grocery delivery/pick-up, getting a slot is difficult. As we heard in the first panel, consumers want to limit time in-store while grocery shopping. This week, we heard the frustration in meeting this desire as the popularity of grocery delivery/pick-up apps and services is making it hard to schedule orders. Some are cutting out the store and shopping directly from the source; others are relying on their local support system for help.

“Before you could schedule a week out, and now you have to check every day to see if there’s availability.”

“We can’t get grocery [delivery] here. I looked into that because I have a son with a compromised immune system. I’m asking a friend to come once a week so I can go to the markets.”

“I’ve set up to do dairy delivery like milk and eggs.”

3. Parents are trying to normalize this time for their kids by setting routines, yet they are relaxing some previous rules and attitudes for both themselves and their kids. Parents are stressed trying to juggle work and homeschooling their children, and their kids don’t fully understand the magnitude of the situation. Parents are prioritizing their kids’ wants over household needs to keep their kids’ anxiety at bay. To keep their kids entertained, parents have made exceptions to previous rules, splurging on streaming and educational apps and allowing normal outside toys, like scooters, indoors.

“It’s been challenging to explain we’re safe inside until it passes.”

“I’m buying more what my kids will eat. I might have one at home; I still buy two at the market so I don’t run out of what my kids need. I can do with less.”

“I make it a point to go out twice a day. I want us to have some routine. We get up and get dressed.”

“I bought these razor scooters for them. I allowed it to be in the house.”

4. Consumers anticipate some of these new habits sticking around. While consumers are looking forward to seeing friends and family, and resuming office work and school, some of these behavior shifts that are a result of the pandemic restrictions have been positive so far. They hope the option for remote working continues when offices re-open. They also plan to continue buying local.

“I tried to make it a point to only order produce from my local farm stand and do meats from an Amish market. I’ll continue with that because the product is better and it’s local.”

“It’s enjoyable that I’m seeing my neighborhood more [taking walks]; I’m not cooped up in the house. I’ll keep it up.”

5. Even with the more somber outlook, consumers can see a silver lining in this time. The theme of togetherness from the first panel was strengthened in this one. Consumers appreciate making new connections and reigniting old ones. They are spending more time with family and in the outdoors. While their world has shrunk by staying at home, their community is expanding.

“I have been using this time to refocus on what’s important to me.”

“There’s a big [fundraiser] in DC with all the bartenders and waitstaff. They’ve put Venmos in a spreadsheet, and it tells you where they work, if they have health insurance and kids. Why wouldn’t you throw them $10?”

“The sense of being with family. Before this happened, things were fast-paced. Now we have the time and we’re enjoying it.”

“I appreciate my friendships more because we’re looking out for each other, supporting each other. This is a life lesson for us all. We forget about others’ needs. We need each other in worse times.”

C+R’s take: The economic impact of the pandemic is hitting close to home.

Support Local: While some consumers have been personally impacted, they are still doing what they can to support their local communities. Who is winning with consumer wallets right now are companies and brands that show solidarity or need the support of their community. Sharing the ways your brand is supporting the community/country in this time, or ways in which you have a local impact will gain your consideration. Think about how you can re-invigorate regional marketing strategies. How can you work with local retailers to ensure friction-free shopping, whether online or in-store?

Connect on an Emotional Level: Think about new ways your brand can connect with consumers on an emotional level to build long-term loyalty. Be authentic and communicate with empathy and compassion. Make a difference to win the shrinking share of wallet by…

- Supporting employees

- Contributions/support to frontline workers

- Offering a charitable promotion

Curious to hear more? We’re hosting another consumer panel focused on the impact on the family on Thursday, April 23 at 12pm Central. Sign up here.

Click here to read about our Five Takeaways from our first live consumer panel!

explore featured

Case studies