Buy Now, Pay Later: Is It Living Up to the Hype?

Filed Under: Gen Z, Millennials, Shopper, Ecommerce, Financial Services, Retail, Behavioral Science, Quantitative Research, Shopper Journey

Kayla Myhre

Director, Shopper Insights Research

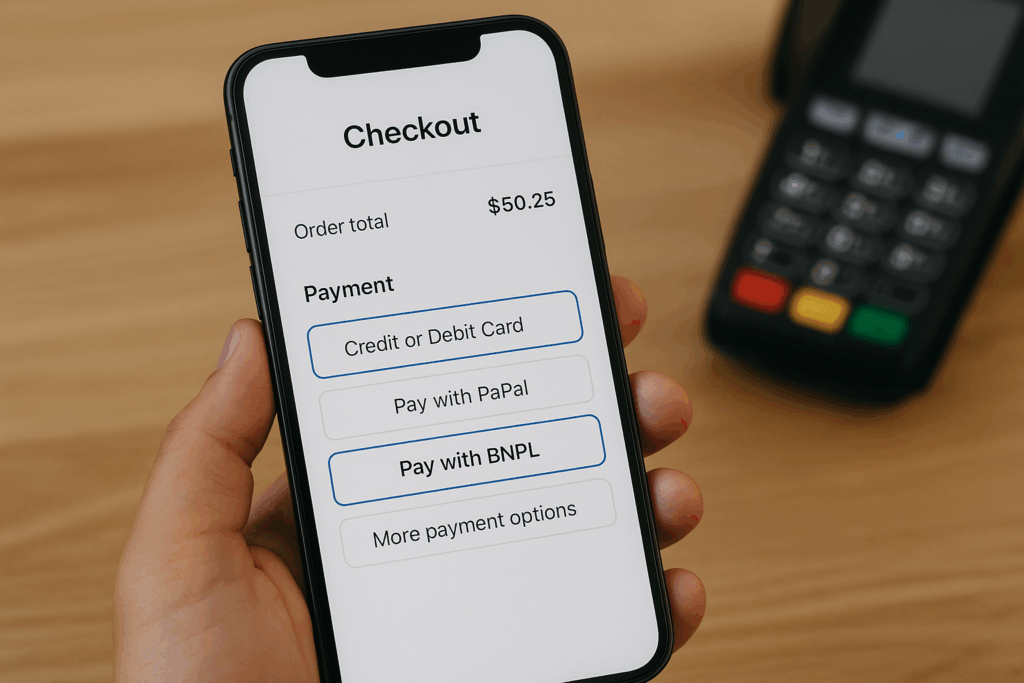

As Buy Now, Pay Later (BNPL) becomes a fixture of the retail landscape, it’s clear this payment option is more than just a trend. Once reserved for luxury purchases, BNPL now reaches across categories—from electronics to everyday essentials—serving as both a convenience and, for some, a necessity.

How BNPL is reshaping shopper behavior

Over the last several years, we at C+R Research have been tracking how BNPL influences consumer behavior and brand perceptions, and how it fits into the broader shopper journey.

The Continued Growth of BNPL

- Rising Adoption: In 2024, an estimated 15% of Americans used BNPL to make a purchase, and nearly a third have used it at least once since its introduction. Growth has been strongest among younger and lower-income shoppers.

- Prime Days Boost: On day one of Amazon’s most recent Prime Days, 6.4% of online orders were made using BNPL, generating $613.4 million in revenue—a 13.6% increase from last year. See more insights from Numerator’s Prime Day data here.

What’s changing: BNPL loans are beginning to factor into FICO credit scores, meaning these payment methods can now impact shoppers’ financial standing—both positively and negatively.

Implications for Brands

BNPL is more than a payment method—it’s part of the shopper experience.

- Meeting expectations: Many shoppers—particularly the Gen Z and Millennials generations—look for BNPL when choosing where to shop. Retailers and brands who fail to offer it risk alienating consumers who now expect it.

- Brand perception: How a retailer communicates BNPL options, fees, and risks can reflect on overall brand equity. Poor experiences with BNPL providers can translate into regret and ultimately diminished trust and loyalty.

- Ethical considerations: Not all industries are a natural fit for BNPL. Some partnerships, like those encouraging BNPL for small, everyday purchases, have sparked criticism for promoting unwise financial behavior.

What This Means for Shopper Research

While payment methods are sometimes overlooked in shopper insights, they can play a key role in the decision-making journey. Payment is one of the final stages of the path to purchase and can leave a lasting impact on shoppers’ overall experiences with a retailer or brand. C+R Research helps brands uncover how these payment preferences intersect with retailer selection, purchase decisions, brand perceptions, and more.

We’re currently conducting internal research to better understand how BNPL compares to other payment options and its role in shaping behavior and loyalty. Early findings reinforce the importance of offering preferred payment methods while communicating them transparently.

Key Takeaways for Brands

- Understand how BNPL influences shopper decisions and brand equity.

- Communicate clearly to help shoppers make informed choices and avoid regret.

- Evaluate whether BNPL aligns with your brand values and audience needs.

For retailers and brands navigating the evolving payment landscape, we can help uncover the consumer behavior trends that matter most. Learn more about our Shopper Insights expertise and how we map the Shopper Journey to inform smarter strategies.

Now On-Demand:

Shopperpulse webinar

What Shoppers See, Think, and Feel Without Saying a Word